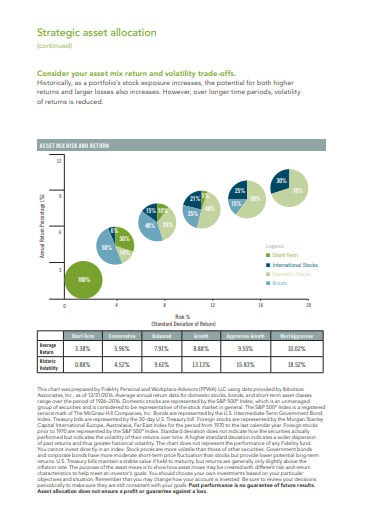

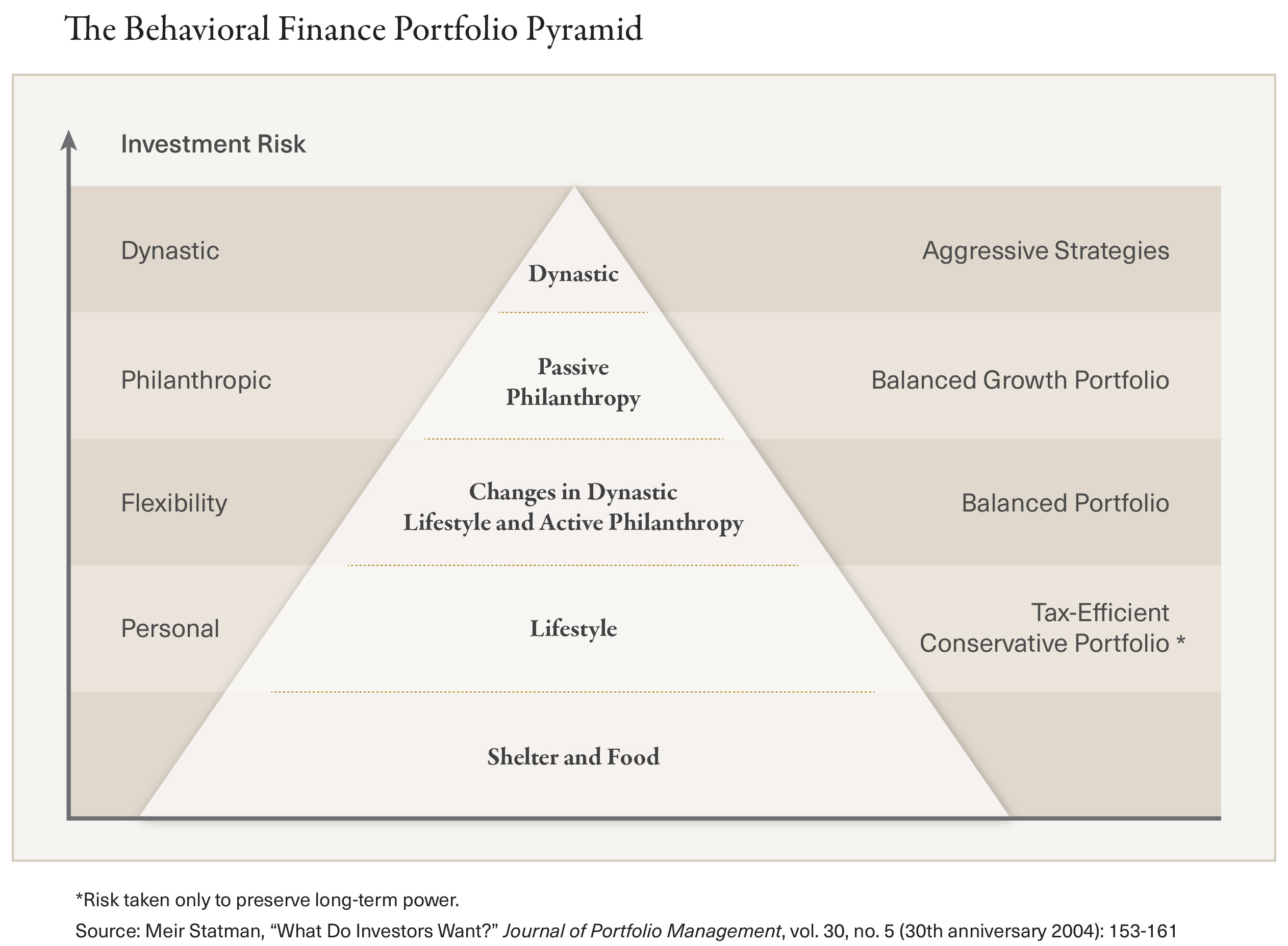

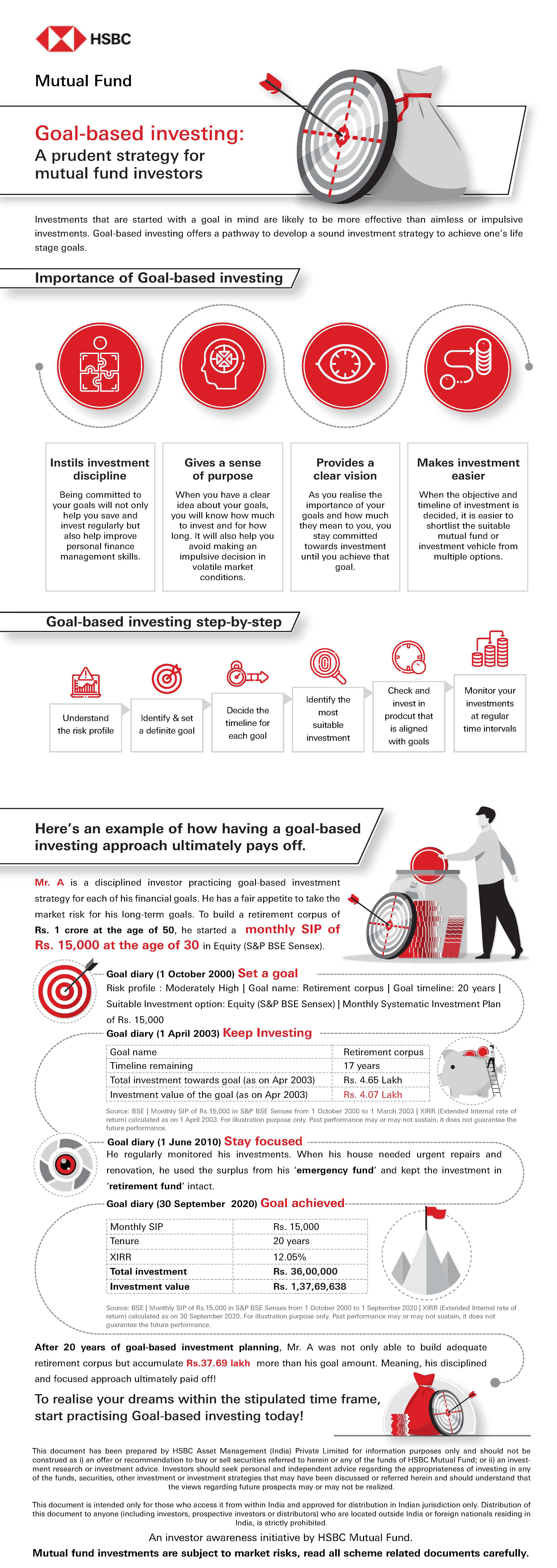

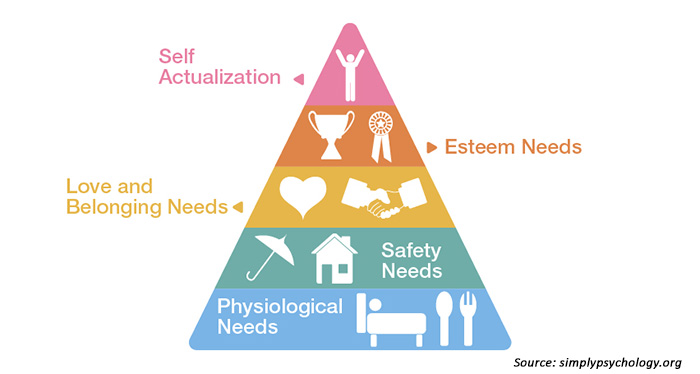

Goalbased investing does away with benchmarks and instead uses the attainment of your goals as a measure of success This shift in focus helps investors elongate their time horizons and alleviates concerns about shortterm market volatility In goalbased investing, investors should separate their goals based on time horizons and priorityGoalsbased investing does not restrict the analysis to the same 2 variables The variables could include theoretically anything income yield, after tax total returns, probability of loss in the short term or the long term, etc Goalsbased investing can also use the same principles ofPrinciples of goalbased investing to the design of a new generation of retirement goalbased investing strategies, which can be regarded as riskcontrolled target date funds that strike a balance between safety and performance with respect to the objective of generating replacement income To provide the investment community

Goals Based Investing An Approach That Puts Investors First

Goal-based investing pdf

Goal-based investing pdf-Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging assets1 Investment Goalsbased investing The new logic in managed investments Matthew WalkerG oalsbased investing is about building and managing investment portfolios to achieve particular outcomes Goalsbased investing focuses on achieving the specific results desired by the end client, the investor, rather than more arbitrary market benchmarks

Applying Goal Based Investing Principles To The Retirement Problem Edhec Risk Institute

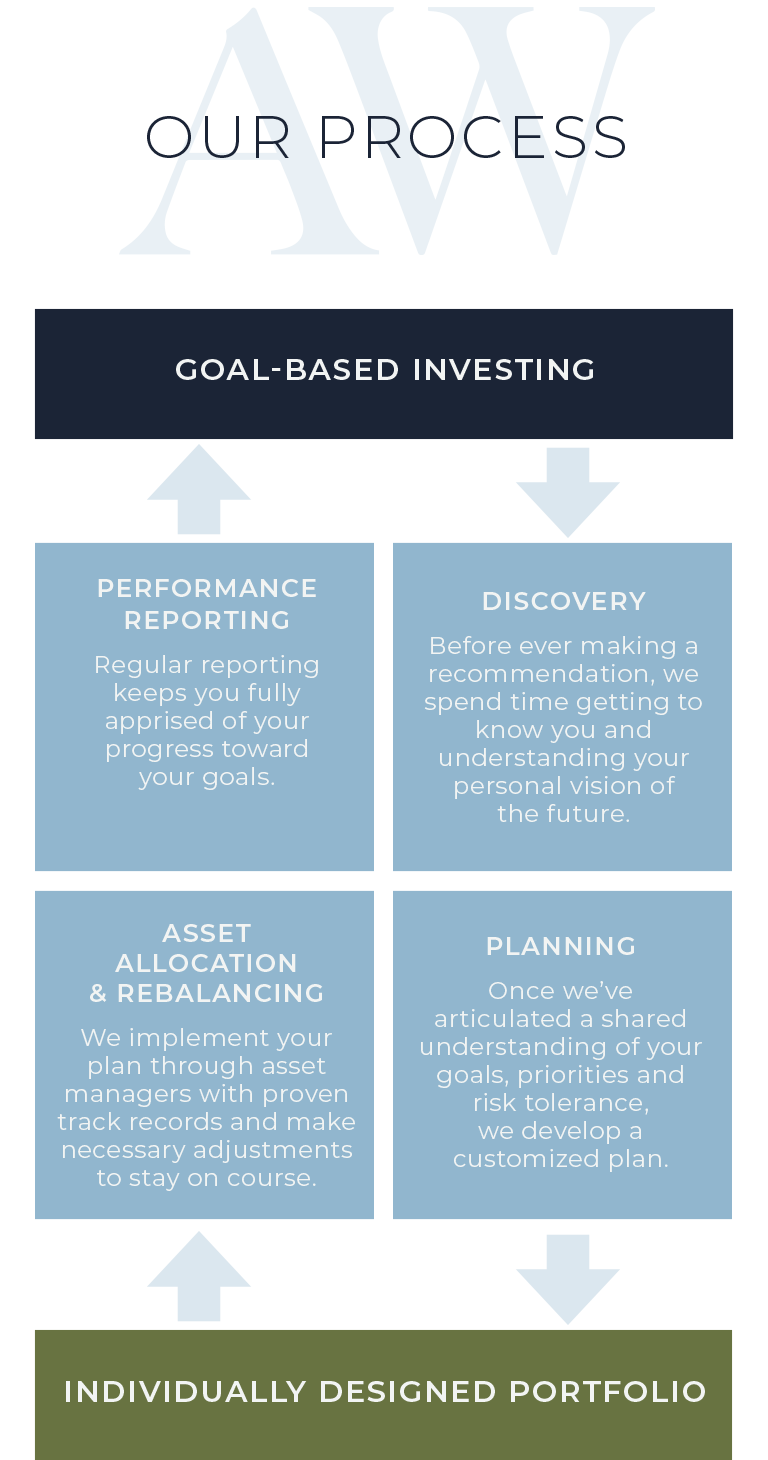

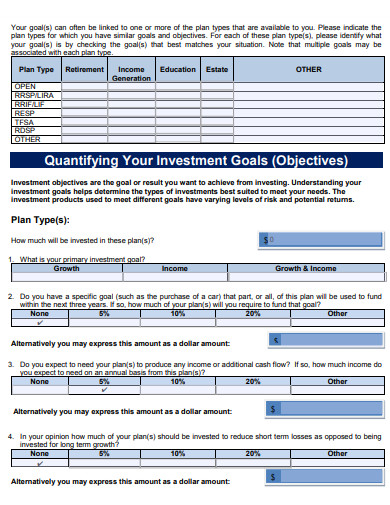

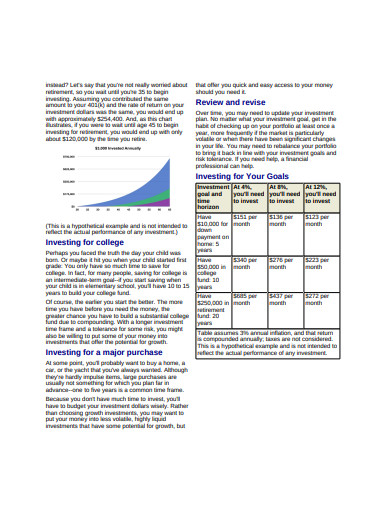

Last Updated on Here is a stepbystep to guide, plus calculator, to begin and track longterm goal based investing Most goal planning calculators tell you how much you should invest This sheets asks you, how much you can invest and goes about calculating the portfolio return With that you can calculate the asset allocation required (equity to fixed incomeSteps to a GoalsBased Relationship 7 GOALSBASED INVESTING Define and Prioritize Goals Gather Information Relative to Current Financial Picture Quantify Probability of Achieving Goals Align Investment Strategy to Match Timing of Cash Needs Monitor Investments and Make Tactical Shifts Review Progress Toward Plan and Revise as New Goals Arise 1Lecture Note 33 GoalBased Investing 2 of such a goalbased investing framework For this, we heavily rely on the material introduced from the previous Lecture Notes with relatively little emphasis of the technical content in order to focus instead on applications An indepth description of the theory and practice of goalbased investing is

Introducing a Comprehensive Allocation Framework for GoalsBased Wealth Management Romain Deguest, Lionel Martellini, Vincent Milhau, Anil Suri, Hungjen Wang This publication introduces a new conceptual framework to better achieve individual investors' goalsStart saving early Learn how to save money first;In the world of investing, where honest and common sense advice is scarce, here is a book that simplifies key concepts in money management and guides you to invest with a specific goal in mind 'You can be rich –With Goal Based Investing' arms you with the relevant questions to ask

Get it now It is also available in Kindle formatOct 17 Arun Muralidhar Goalsbased Investing (GBI) is slowly becoming the norm for investors Individuals save for a range of goals (eg, retirement, aLasso puts investors and advisors on the same side We've made it easy to build a plan for your money No financial knowledge needed And, we're creating a community of investors and advisors that is based on sharing information about people's goals When the conversation is focused on what really matters your goals we think everyone wins

Afn Work And Wealth Initiative Asset Funders Network

:max_bytes(150000):strip_icc()/ellevest-vs-betterment-ebf2bcde1eec4958969a2d2171f2687c.png)

Goal Based Investing Definition

Of our goalbased investing methodology may allow the advisor to consider broader and richer investment opportunity sets WealthBench does not contain investment choices (eg, a menu of available mutual funds) or recommend any specific investments PAOLO SIRONI is a global thought leader for Wealth Management and Investment Analytics at IBM, where he is responsible for promoting quantitative methods, Goal Based Investing (GBI) and digital solutions for financial advisory His expertise combines financial services and technology and spans over a number of areas, including wealth management, assetGoalsbased wealth management (GBWM) models, see Chhabra (05), Brunel (15), and Das et al (18) In GBWM, we seek to maximize the probability that an investor's portfolio value W will achieve a desired level of wealth H—that is, W(T) ≥ H at the horizon T for the goal Starting from time t = 0, with wealth W(0), every year, we will

11 Investment Goals Templates In Doc Pdf Free Premium Templates

Fintech Innovation Pdf Fintech Robo Advisors Gamification

The Goals Driven Investing approach matches these goals with the appropriate assets and investment strategies based upon each goal's time horizon and your risk preferences, or the degree of confidence you desire for attaining each goal A FEELING OF CONFIDENCE AND SECURITY In the case of our nervous investor, hisGoal Based Investing Theory And Practice by Romain Deguest,Lionel Martellini,Vincent Milhau Pdf ePub Full Download Ebook Goal based investing is a new paradigm that is expected to have a profound and loGoalsbased investing is an approach which aims to help people meet their personal and lifestyle goals, whatever they may be, in a straightforward and simple way It does this by placing people's goals right at the centre of the advice process and aims to

Pin On Products

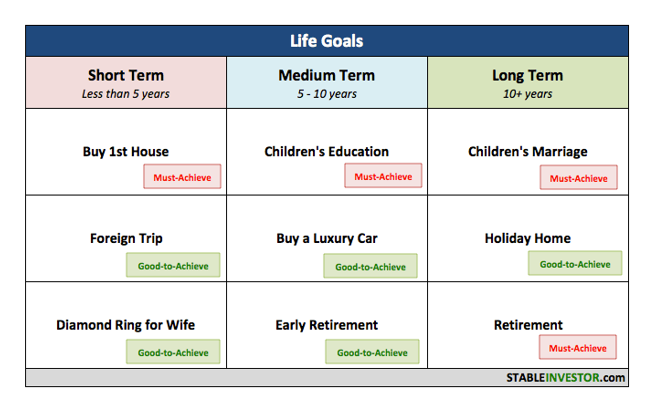

What Is Goal Based Financial Planning Anyway Stable Investor

Investing, helps bring the safetyfirst, goalsbased investment portfolio approach to the forefront of financial planning, especially when it comes to preparing for retirement The idea from which the book proceeds is to focus on retirement spending goals Download free ebook of You Can Be Rich Too With Goal Based Investing soft copy pdf or read online by" P V Subramanyam","M Pattabiraman"Published on by TV18 BROADCAST LTD This Book was ranked at 28 by Google Books for keyword Personal Finance Retirement Planning prime books Book ID of You Can Be Rich Too With Goal Based Investing's Books The investment goals are the income that provides the general starting point for the investment goal and the things that you can not invest that you do not have The first career job issue is the call for many young minds, forcing to take their decision in contributing on 401(k) or the savings or the money market accounts changes needed to balance growing property with the

Goals Based Investing Integrating Traditional And Behavioral Finance Jakub Karnowski Cfa Portfolio Management For Financial Advisers Ppt Download

Goals Based Investing An Approach That Puts Investors First

You Can Be Rich Too with GoalBased Investing Published by CNBC TV18, this book is meant to help you ask the right questions, seek the correct answers, and since it comes with nine online calculators, you can also create custom solutions for your lifestyle!F inancial planning is a goalsbased profession Financial planners help clients determine how to accomplish their goals through advice and guidance on a variety of topics, such as saving, investing, and risk management While investing well is generally an important part of the process of accomplishing a goal, achieving a goal often requires advice beyond building appropriateGoalsBased Investing or GoalDriven Investing (sometimes abbreviated GBI) is the use of financial markets to fund goals within a specified period of timeTraditional portfolio construction balances expected portfolio variance with return and uses a risk aversion metric to select the optimal mix of investments By contrast, GBI optimizes an investment mix to minimize the

Goals Based Investing An Approach That Puts Investors First

Pdf Applying Goal Based Investing Principles To The Retirement Problem Semantic Scholar

Request PDF On , Romain Deguest and others published Goalbased Investing Theory and Practice Find, read and cite all the research you need on ResearchGateThen learn how to invest We'll use riskfree strategies to accumulate savings in this episode, and then iGoalsbased investing But regardless of the approach, goalsbased investing should be built on first principles and foundational research The purpose of this article is to propose that any sound goalsbased asset allocation method should contain the following four characteristics 1 An anchor to portfolio theory 2

Goals Based Investing Private Wealth Partners

Services

The goalbased model presented in this paper is wellsuited to study how investors allocate their wealth between short, medium and longterm investment goals We address the question whether investors with several investment goals at di erent horizons mainly invest to reach short, medium or longterm investment goals It is wellknown thatInvestment decisions should be made based on the investor's specific financial needs and objectives, goals, time horizon, tax liability, and risk tolerance When investing in managed accounts and wrap accounts, there may be additional fees and expenses added onto the fees of the underlying investment productsDownload You Can Be Rich Too With Goal Based Investing full book in PDF, EPUB, and Mobi Format, get it for read on your Kindle device, PC, phones or tablets You Can Be Rich Too With Goal Based Investing full free pdf books

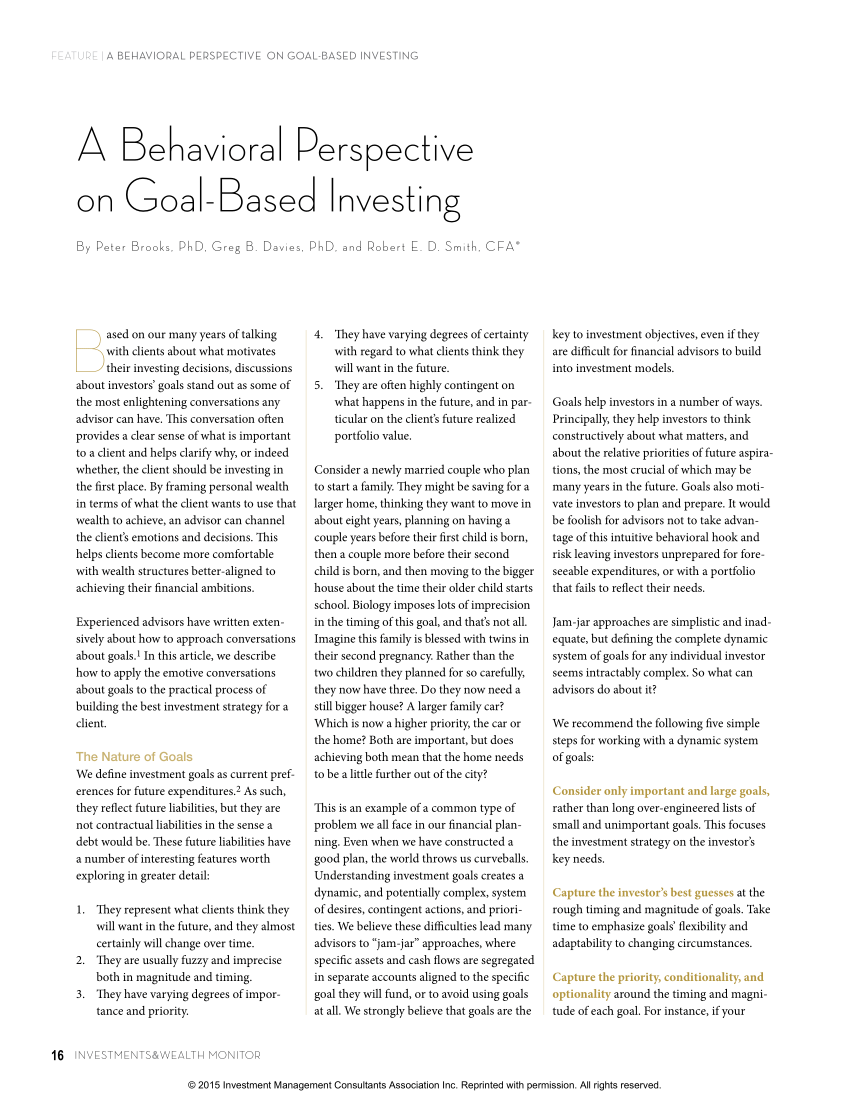

Pdf A Behavioral Perspective On Goal Based Investing

Factor Investing In Liability Driven And Goal Based Investment Solutions Edhec Risk Institute

Goalsbased investing empowers intermediaries, institutions and individuals alike to focus on what really matters achieving goals And when you marry those goals with our global economic perspective, it's a powerful framework that Incorporates cuttingedge insights from behavioural finance Helps keep investors focused on the right thingsGoalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging assetsThe authors propose the use of goal based investing—or private ALM, as they prefer to call it—to tailor a dynamic investment strategy to the needs of individual clients They argue that this approach is superior to the "onesizefitsall," targetdateoriented static allocation path used in most current life cycle funds

The New Bubble

Goal Investment Plans Decide The Asset Class With Your Financial Advisor That Suits You Work Backwards And Calculate The Amount You Could Invest Through Sip Or A Lumpsum Or A Combination Of

Grounded in the principles of asset pricing and portfolio optimisation, the goalbased investing approach leads to the design of investment solutions that truly respond to investors' problems, which can most often be summarized as follows secure essential goals with the highest confidence level and maximize the chances to reach aspirational goalsA series of case studiesPART THREE Goal Based Investing is the Spirit of the Industry CHAPTER 6 The Principles of Goal Based Investing Personalize the Investment Experience 85 61 Introduction 85 62 Foundations of Goal Based Investing 63 About personal needs, goals, and risks 91 64 Goal Based Investing process 96 65 What changes in portfolio modelling 97 Synopsis Goal based Investing Theory And Practice written by Romain Deguest, published by World Scientific which was released on 13 July 21 Download Goal based Investing Theory And Practice Books now!Available in PDF, EPUB, Mobi Format Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth

Globalcanopy Org

Goals Based Investing And Why It Matters Endowus Sg

Investments Goalbased investing o˚ers a pathway to develop a sound investment strategy to achieve one's life stage goals A prudent strategy for mutual fund investors Goalbased investing Importance of Goalbased investing Goalbased investing stepbystep ` Understand the risk profile Identify & set a definite goal Decide the timelineGoalsBased Investing—Aligning Life and Wealth 2 GoalsBased Investing—Aligning Life and Wealth Goalsbased investing offers a powerful tool to help steel clients against market fear and uncertainty by better managing human preferences, biases and behaviours that can undermine their financial successThe basis for the goalsbased wealth management approach developed in this paper In its simplest form, goalsbased wealth management can be defined as a process that focuses on helping investors realize their goals, both shortterm and longterm, through a portfolio management method primarily focused on reaching welldefined financial goals

Pdf Applying Goal Based Investing Principles To The Retirement Problem Semantic Scholar

Pdf Applying Goal Based Investing Principles To The Retirement Problem Semantic Scholar

Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging assetsGoalsBased Investing The sustainable spending rate is defined as the amount of spending that the investor can be confident of maintaining without running out of capital The worst sustainable spending rate considers the lowest level that the sustainable spending rate might reach at any time prior to the horizonA goalsbased framework in nancial planning can lead to an increase in wealth for investors (Blanchett 15) and has the potential to strengthen plannerclient relationships 1 As such, more planning professionals are practicing goalsbased or goalscentric nancial planning (Lee, Anderson, and Kitces 15) T he success of goalsbased planning

Why Practicing Goal Based Investing Is Essential For Small Investors

The Power Of Goal Based Investing First Republic Bank

Goalbased investing, many investors achieve more of what matters to them and avoid a number of behavioral ine!ciencies that lower overall portfolio value, make portfolios more di!cult to manage, lower the number of goals achieved in full, and consequently, lower overall investor satis("liabilitydriven" investing, in the language of pensions) Goalbased investing is more than just a form of mental accounting that assigns labels like "house," "college" or "retirement" to different pots of money A switch to goalbased investing, for instance, changes the way advisors assess their clients' risk capacity

Rpa Federal Decision Making In Transportation Investments

Impact Investments Harvard Business School

Srdas Github Io

Do Your Investments Match Your Financial Goals

Goals Based Investing Integrating Traditional And Behavioral Finance Jakub Karnowski Cfa Portfolio Management For Financial Advisers Ppt Download

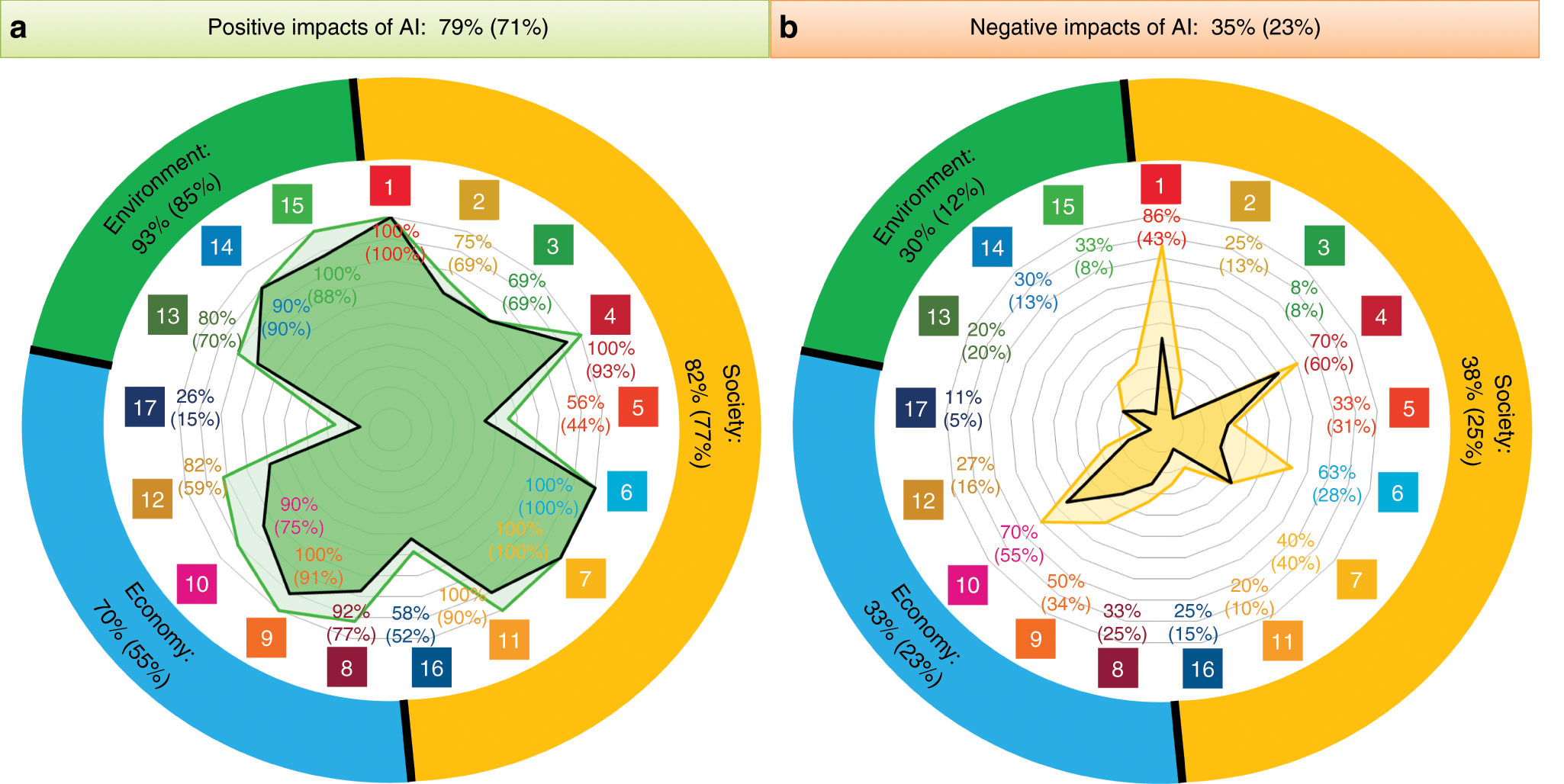

The Role Of Artificial Intelligence In Achieving The Sustainable Development Goals Nature Communications

Goal Based Investing Process Investment Benefits Wiseradvisor Infographic

11 Investment Goals Templates In Doc Pdf Free Premium Templates

Goals Based Investing Suggested As Replacement To Advisers Traditional Approach Ardent Wealth

Plan In A Targeted Manner And Achieve Your Financial Goals Ubs Switzerland

Pdf Applying Goal Based Investing Principles To The Retirement Problem Semantic Scholar

Rankmf Baskets The Best Approach To Goal Based Investing

Applying Goal Based Investing Principles To The Retirement Problem Edhec Risk Institute

Introducing Flexicure Goal Based Investing Retirement Solutions Edhec Risk Institute

Goals Based Investing From Theory To Practice

Srdas Github Io

What Is Goal Based Financial Planning Peak Financial Services

Goals Based Investing Integrating Traditional And Behavioral Finance Jakub Karnowski Cfa Portfolio Management For Financial Advisers Ppt Download

1

Goal Based Investing Wikipedia

Goal Based Investing How Does It Work Everyfin Newsletter

Karnowski Pl

Goal Based Investing Alpha Wealth Advisors Llc

A Framework For Goals Based Investing Boston Private

Evidence Based Investing The Evidence Based Investor The Evidence Based Investor

You Can Be Rich With Goal Based Investing A Book By Subra Pattu

Download Pdf Fintech Innovation From Robo Advisors To Goal Based Investing And Gamification The Wiley Finance Series Full Books

I Am Now Ready To Do Goal Based Investing What Now Arthgyaan

11 Investment Goals Templates In Doc Pdf Free Premium Templates

How Goal Based Investing Can Help You Build Wealth Cashing To Wealth

11 Investment Goals Templates In Doc Pdf Free Premium Templates

Pdf Applying Goal Based Investing Principles To The Retirement Problem Semantic Scholar

Why Practicing Goal Based Investing Is Essential For Small Investors

Goals Based Investing For Affluent Families And Individuals Sei

Merrill Edge Online Investing Trading Brokerage And Advice

Goal Based Investing Theory And Practice Edhec Risk Institute

Finance Technology Sironi Finance Technology Robo Advisors And Goal Based Investing Pdf Document

Goals Based Investing Should It Be The Norm Cfa Institute Enterprising Investor

Srdas Github Io

How I Save For Short Term Goals

4 Things To Keep In Mind While Investing In Mutual Funds For Retirement Product Presentation Leaflet

Eton Advisors Wealth Management

Investment Management Integrated Wealth Management Financial Planner Investment Management Seattle

Key Management Group Themed Meetings Make Client Prep Easier And Give Your Team A Structure To Follow Contact Us To Learn More About Our Client Meeting Prep Services Keymanagementgrp Com Images Kmg Themed Meetings Final Pdf Facebook

Rockpa Org

Why Practicing Goal Based Investing Is Essential For Small Investors

:max_bytes(150000):strip_icc()/Bettermentvs.Wealthfront-5c61bcf246e0fb0001dcd5c2.png)

Goal Based Investing Definition

Learn More About Goal Based Investing Today Iinvest Solutions

Educational Infographics

Storage Googleapis Com

Goal Based Investing And Application To The Retirement Problem Edhec Risk Institute

Unified Wealth Platform Fact Sheet Brochure Fiserv

1

Learn More About Goal Based Investing Today Iinvest Solutions

Goal Based Investing Is The Modern And Correct Way To Personal Wealth Management And Investing Investorpolis

Pdf Applying Goal Based Investing Principles To The Retirement Problem Semantic Scholar

Goal Based Investing Through Mutual Funds Youtube

A New Vision For Great Governance

Maheshhhtapio Firebaseapp Com

Back To The Future The Return Of Objective Based Investing Capital Group Canada Insights

Steelejn71 Web App

Automated Investing Online Investing Chase Com

Act Accelerator Investment Case Invest Now To Change The Course Of The Covid 19 Pandemic World Reliefweb

Evidence Based Investing Seeking Alpha

Goal Based Investment Gold Property Investment Advice Bmfpa

What Is Goals Based Investing And How Does It Work Manulife Private Wealth

How To Pick The Best Investment Tool For You Ally

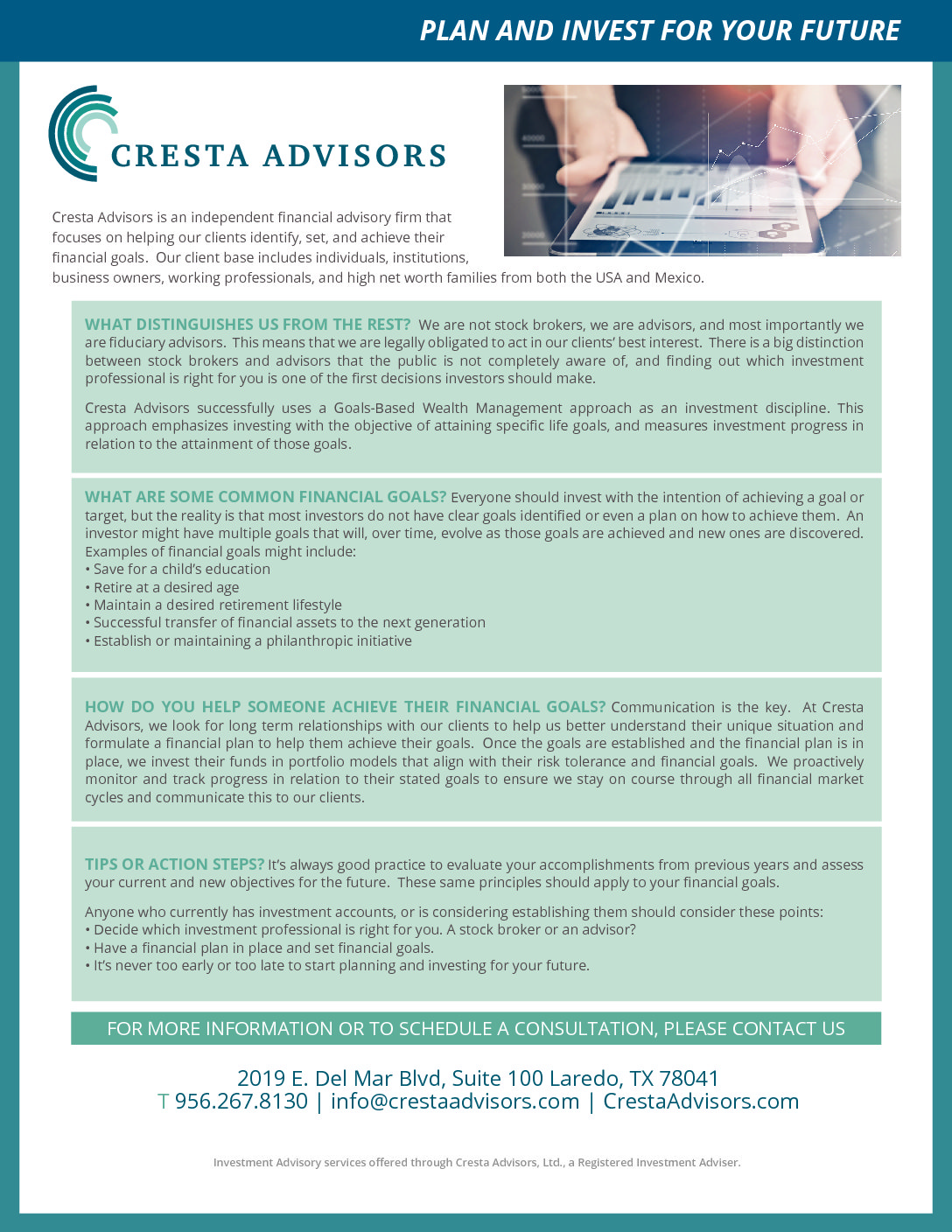

Resources Cresta Advisors Financial Planning Financial Advisor

Advisory Solutions Expectations And Experiences Executive Summary Money Management Institute

Real Success With Goals Based Investing Proactive Advisor Magazine

Goals Based Investing For Affluent Families And Individuals Sei

Learn More About Goal Based Investing Today Iinvest Solutions

Goal Based Investing Alpha Wealth Advisors Llc

Investing With Sdg Outcomes A Five Part Framework Thought Leadership Pri

Goal Based Investment Benefits Strategy Wiseradvisor Blog

Goals Based Investing Integrating Traditional And Behavioral Finance Jakub Karnowski Cfa Portfolio Management For Financial Advisers Ppt Download

Pdf Applying Goal Based Investing Principles To The Retirement Problem Semantic Scholar

Arthur Sipho Read You Can Be Rich Too With Goal Based Investing Pdf

Pdf Applying Goal Based Investing Principles To The Retirement Problem Semantic Scholar

Investors And The Sustainable Development Goals Thought Leadership Pri